Payroll Software for Small Businesses

PAYROLL THAT’S ALWAYS READY TO ROLL.

From clock-in to payday, your team’s hours, wages, and taxes sync automatically — so you’re always ready to payroll.

Everything it takes to pay your team, made easy.

Automated

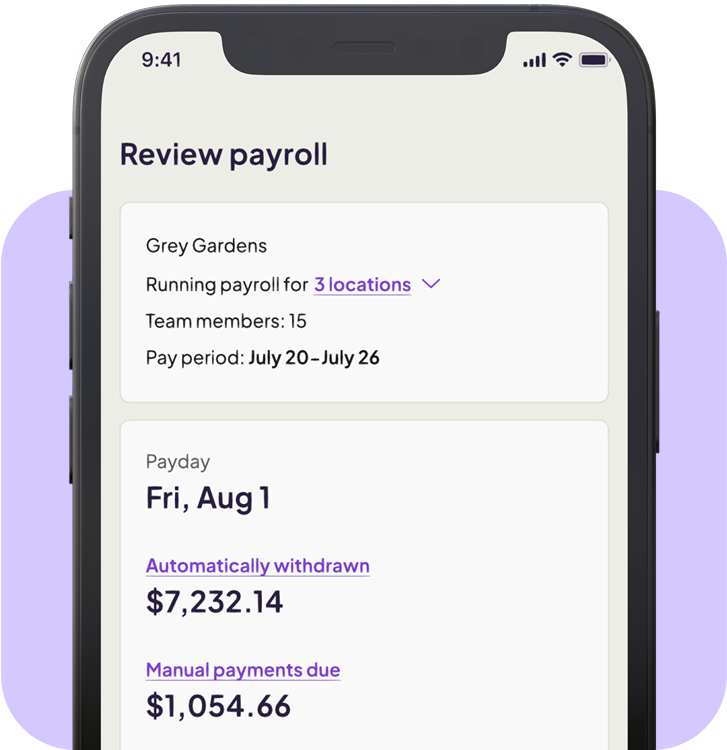

Run payroll with wages, tips, breaks, overtime, and more calculated for you.

Accurate

Stay compliant and up-to-date with PTO policies, taxes, labor laws, and FLSA rules.

All in sync

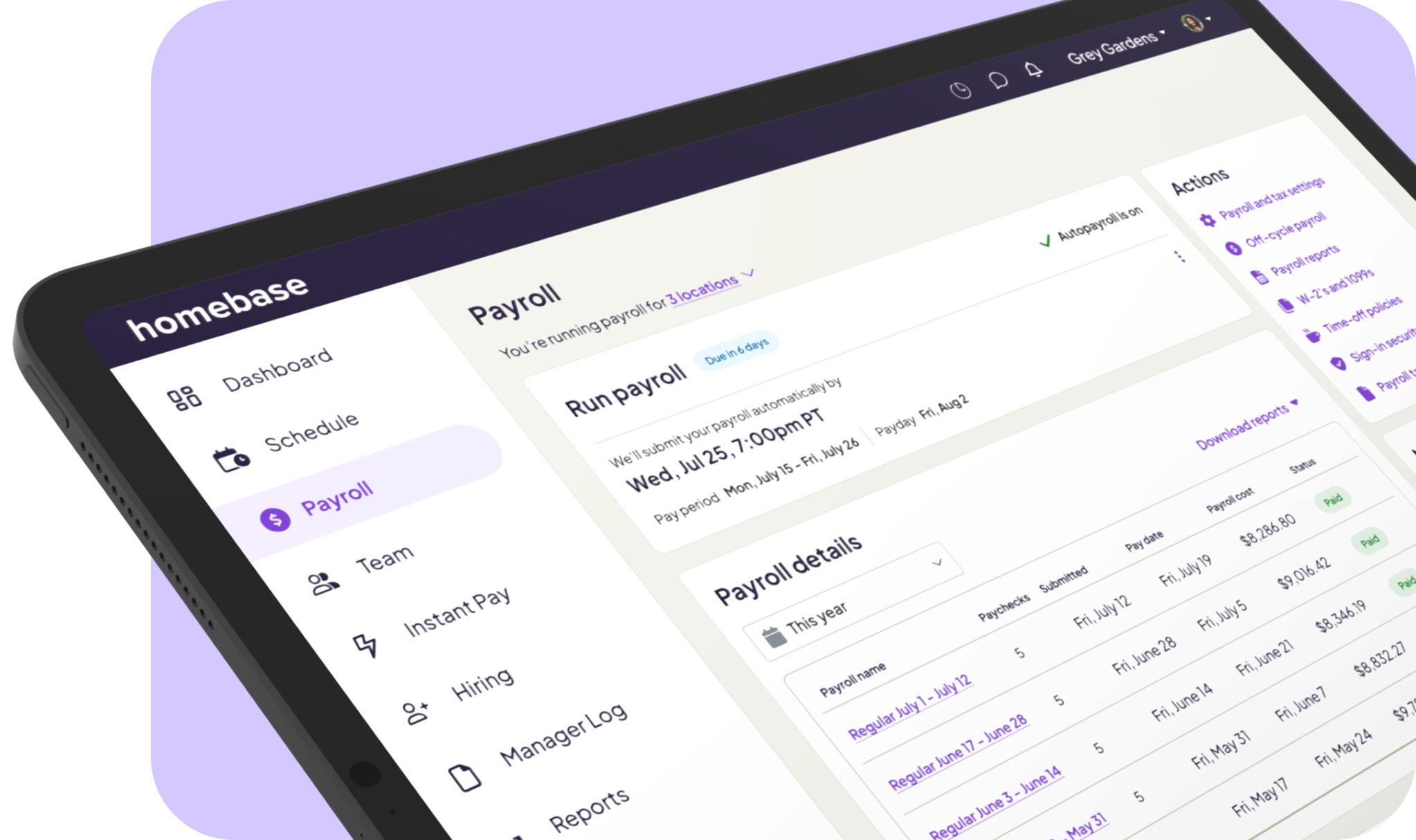

Schedule, track hours, and pay your team from one easy app, not multiple systems.

See the payroll product in action.

“It's been nice to have control of things, make them streamlined, and just have a consolidated, like, scheduling, payroll experience.”

Keegan Fong, Owner, Woon

“It's been nice to have control of things, make them streamlined, and just have a consolidated, scheduling, payroll experience.”

Keegan Fong, Owner, Woon

Save time. Save money.

Small businesses save an average of 5 hours monthly and $3,500 annually with Homebase Payroll.

Automated tax calculation, filing, and payment

Direct deposit & printable checks

W-2s and 1099s

Full service payroll

Wage garnishments

Employee self service

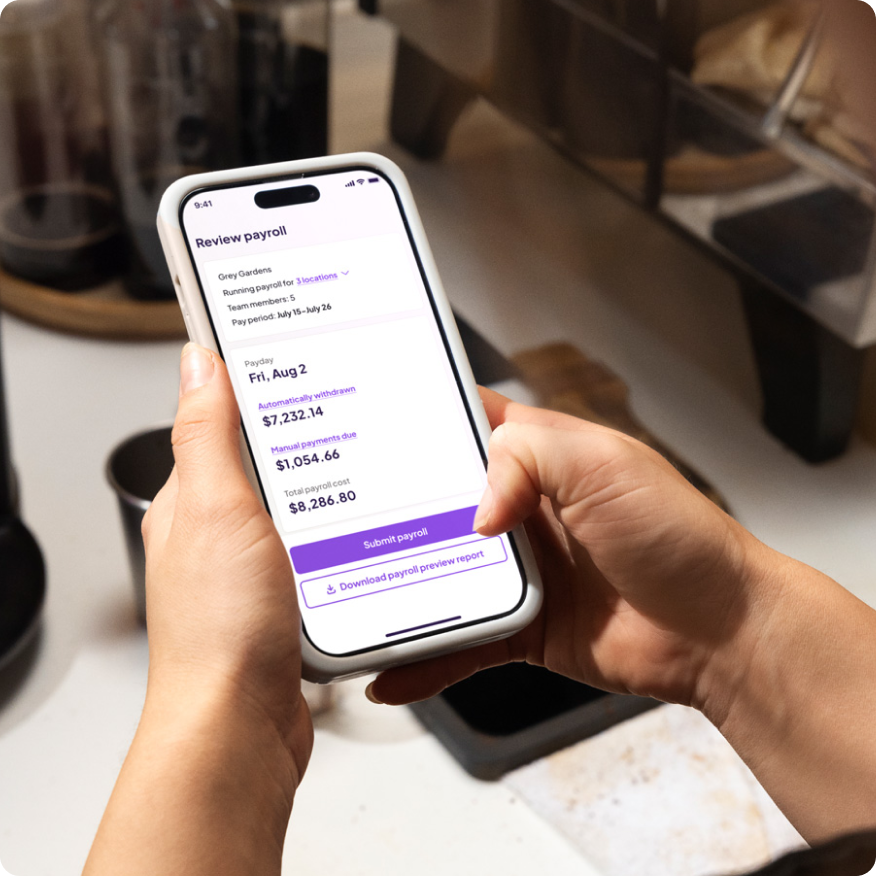

Mobile payroll app

Unlimited payroll runs

Automated payroll

Integrated scheduling & timesheets

Tip Management

Next Day payroll

Payroll reports

All for just $39/month base fee + $6/month per active employee.

Homebase customer survey of 385 product users, October 2024. Margin of error: ±5% at 95% confidence level.

Switching payroll providers

The switch is smooth.

- We’ll transfer your pay and tax data over for you

- No implementation fees (the entire setup is free!)

- Get up and running in less than 30 mins

- Onboarding & support from a dedicated payroll expert

Payroll that resonates.

150,000+ hourly teams and 2 million employees rely on Homebase for their everyday needs.

Best Payroll for Automation

2024

Best Payroll for Small Business

2024

Best Payroll for Hourly Teams

2024

Payroll demo

Ready to see it in action?

Connect with a payroll expert to see how it all works.

The everything app for hourly teams.

Spend less time wrangling logins and transferring data. Homebase comes with everything else you need to manage your team.

FAQs

What's included in payroll?

How much does payroll cost?

Where is payroll currently available?

How to run payroll?

What is a good payroll example?

6 Months Free: Payroll & Plus Plan

Save hours every week with payroll, scheduling, and time tracking all in one easy app. Switch now to save. Offer ends January 31, 2026. Terms apply.

Save hours every week with payroll, scheduling, and time tracking all in one easy app. Switch now to save. Offer ends January 31, 2026. Terms apply.

.png)