What is monthly pay?

Monthly pay refers to a payroll schedule where employees are paid once a month, typically on the same date each month, like the 1st or the last business day. It’s one of several standard pay frequency options, alongside weekly, biweekly, and semimonthly pay.

For small business owners, choosing a monthly pay schedule might seem more straightforward on the surface—after all, it means fewer payroll runs each year. However, it also comes with trade-offs, especially regarding cash flow planning and employee satisfaction.

How monthly pay works

When you choose a monthly pay schedule, employees receive one paycheck each month for all the hours they worked during that pay period. For salaried employees, this typically means dividing their annual salary by 12. For hourly workers, it means totaling all the hours they worked that month, including overtime.

Here’s a quick breakdown:

- Pay frequency: 12 paychecks per year

- Typical pay date: Same calendar date every month (e.g., the 30th or last Friday)

- Pay period: Usually runs from the 1st to the end of the month

Monthly pay can work well for salaried roles and businesses that want to simplify their payroll process, but it may not be the best fit for every team. Consider your employees’ needs and state laws before settling on a pay schedule.

You can use small business payroll software to automate your pay periods, so that employees are always paid accurately and on time. Especially with longer pay schedules like a monthly schedule, it’s important not to miss a detail when running payroll.

Pros of monthly pay for employers

There are many reasons you may want to go with a monthly pay schedule as an employer. Here are the highlights:

- Fewer payroll runs: Only processing payroll once a month saves time and administrative work.

- Lower payroll costs: Some payroll services charge per run, so monthly pay can be more cost-efficient.

- Simplified accounting: Monthly payroll aligns well with monthly reporting and budgeting.

Cons of being paid monthly for employees

Unfortunately, employees see fewer benefits when payroll is set to a monthly schedule. Here are some reasons your team may not like having a monthly pay period:

- Long gaps between paychecks: Some employees may struggle to manage bills and personal expenses on a once-a-month schedule.

- Difficult for hourly workers: Monthly pay can feel inconsistent for employees with variable hours or shifts.

- Reduced flexibility: If a payday falls on a weekend or holiday, the timing of that month’s paycheck may shift.

Because of these drawbacks, monthly pay is more common for salaried employees and less common in industries with hourly or shift workers, like retail or hospitality.

Is monthly pay allowed in every state?

Not always. While monthly pay is legal in many states, some states have strict rules about how often employees, especially hourly workers, must be paid.

For example:

- California and New York require more frequent pay for hourly employees

- Texas and Illinois allow monthly pay, but only for certain types of employees

Make sure to check your state’s labor laws before setting up a monthly pay schedule.

Monthly pay vs. other pay frequencies

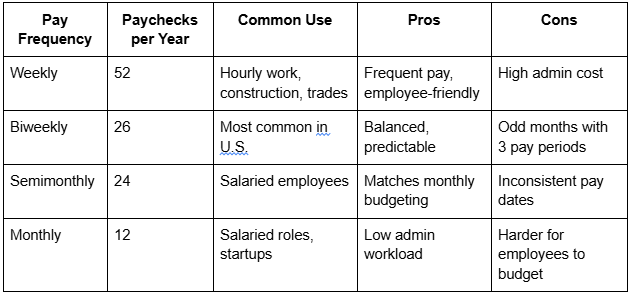

So how do you decide what pay frequency to use? Here’s a quick comparison to help you decide what’s right for your business:

How to implement monthly pay

If you’re switching to or starting with monthly pay:

- Set expectations: Communicate clearly with your team about when and how they’ll be paid.

- Use a reliable payroll provider: Make sure taxes, deductions, and payments are calculated correctly.

- Automate time tracking: Especially important for hourly or mixed teams.

- Provide budgeting tools or support: Help employees adjust to less frequent pay.

Using a platform like Homebase Payroll, you can easily set up monthly payroll, automate tax filings, and make sure everyone gets paid accurately and on time.

Sign up for Homebase today to streamline payroll, whether you pay monthly or more often.